It will not cover fixings to your car if you're at fault in an accident or have non-crash-related damage. If you are looking for added coverage, you can learn much more regarding the most usual sorts of car insurance policy. If you have a funding or lease, you still need to pay your lender also if your vehicle is completed and you can no much longer drive it.

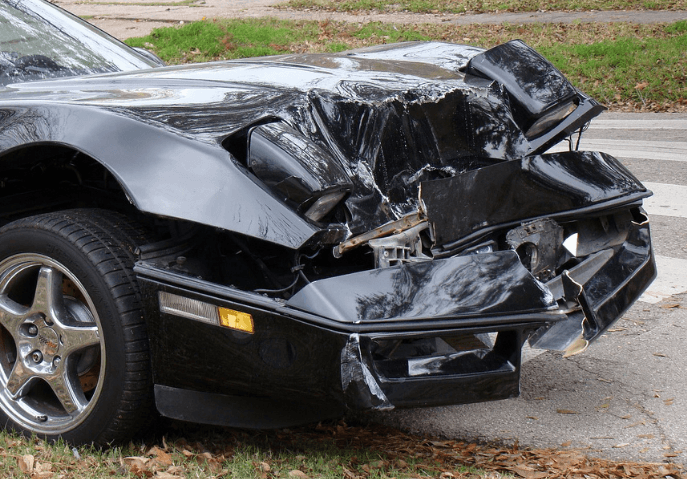

If this takes place, the provider will repay you for the real cash money worth of the automobile (cheapest auto insurance). Also if you enter https://carrentalinsurance.blob.core.windows.net/$web/index.html an auto accident as well as your lorry is not totally totaled, your insurance provider might still spend for your repairs. You might be able to keep a completed car, however it depends on your state's legislations.

You may be limited in the kinds of protection the insurance coverage firm is prepared to sell you. "Some insurance coverage firms only insure restored, or rebuilt-titled vehicles for liability only.

auto insurance company vehicle cheaper car

auto insurance company vehicle cheaper car

It depends on the lorry. When an insurer amounts to a vehicle, it pays the vehicle's actual cash money value promptly before the loss occurred. The ACV consider devaluation, which consists of damage, mileage, as well as previous accidents, so the reimbursement amount will be much less than what you paid for the cars and truck.

You can examine resources like Kelley Blue Schedule and collect details concerning what comparable autos are costing in your location. Existing the details to the adjuster and see if you can pertain to an agreement. "If you can't resolve it with the insurance adjuster, you can head out as well as hire an exclusive evaluator," Damico stated.

If the evaluator's estimate is greater than what the insurance coverage company supplies, you can utilize it to discuss. Otherwise, you may have to accept the insurance firm's offer. If your vehicle is totaled, there are a few steps to take to resolve your case as well as obtain back when driving.

The 4-Minute Rule for Insurance Company Deducting Storage Fees From Total Loss ...

If you have a funding or lease, your car is what is safeguarding your financing. You need to let the funding company understand regarding the damage and also you need to proceed making your payments. If you stop, it could negatively impact your credit, making it a lot more difficult to get financing for a new lorry (credit score).

The most typical percentage is 75%, yet limits vary from as high as 100% to as low as 50% in some states. Can I Challenge an Insurer's Choice to Total My Cars and truck? You don't need to accept the insurance provider's choice to complete your vehicle. You can bargain with your very own insurer or the insurer of the person or entity responsible for the accident, usually the at-fault driver (perks).

If they don't, you can file a complaint with your state's insurance compensation or much better service bureau. You can additionally attempt to dispute the adjuster's price quote for repair services.

That Spends for My Totaled Automobile? After a total loss accident, insurance policy will likely play a big role in your settlement. The insurance coverage that kicks in to spend for your completed automobile usually relies on who's at fault for the accident. What Occurs If I'm at Fault for the Mishap? If you are legitimately in charge of a crash, you'll need to depend on your very own accident and also detailed cars and truck insurance policy to cover your completed vehicle.

Accident protection pays out for car-on-car accidents and single vehicle accidents. A lot of states don't require vehicle drivers and also cars and truck proprietors to have accident insurance, but lending institutions often make it a condition of an auto loan (cheaper car insurance). Comprehensive insurance covers non-collision damage, like damage triggered by a falling tree, serious climate, fire, theft, and vandalism.

If your automobile is amounted to in a mishap that you created as well as you don't have crash or detailed coverage, you'll get no money for your amounted to auto. What Takes place If I'm Not at Mistake for the Crash? In most states, the individual that is at mistake for the accident is accountable (legally liable) for spending for residential or commercial property damage.

Unknown Facts About 5 Things You Must Know To Negotiate An Auto Insurance ...

perks affordable auto insurance cheaper cars prices

perks affordable auto insurance cheaper cars prices

If you own your vehicle outright, the whole insurance policy settlement will certainly go to you. If you funded your completed automobile, the insurance provider will pay your loan provider initially. If your vehicle's ACV is greater than what you owe, you'll keep the distinction. If your cars and truck's ACV is less than what you owe, you are still responsible for paying the balance of your financing.

, Cars for U.S.

Your settlement should be must to sufficient the purchase of a car nearly auto virtually similar one you lost. New auto substitute coverage is an add-on to crash as well as comprehensive insurance coverage for new cars with low gas mileage. New auto substitute and gap insurance coverage both lead to bigger payments for completed autos, yet they aren't the very same and also you'll have to pay for them individually.

However if you were injured or you wish to contest the insurance provider's choice to complete your automobile, speak with an auto mishap attorney. An experienced car crash legal representative can address your concerns concerning the complete loss process and also describe your legal rights when you are discussing a settlement with an insurer - car insured.

You can additionally link with a legal representative straight from this page free of charge (auto).

Getting My What Is The Total Loss Value Of My Vehicle? - Law Office Of ... To Work

You may obtain lucky, be dealt with pleasantly as well as properly, and used a reasonable as well as just negotiation. How Do Some Insurer Run? On the other hand, an at-fault driver's insurance coverage firm could use you an amount that deserves far much less than the actual value of your case. This is exactly how some car insurance coverage firms maintain pay-outs to a minimum.

insurers cheap car insure insurance affordable

insurers cheap car insure insurance affordable

Can You Work Out Without an Attorney's Help? Yet if you are just handling property damages, and also you believe that you are being dealt with relatively, there's nothing incorrect with performing your very own settlements with an insurer. Understand as well that complete loss insurers have little negotiating authority by themselves and also needs to address to elderly insurance adjusters as well as supervisors who make the vital insurance coverage, obligation, and also working out choices.

An insurer may tell you that the business's very first offer is one of the most that the business can pay you, however that simply isn't real. If you have evidence which proves that your vehicle was worth dramatically more than the insurer's offer, a failure insurance adjuster can take the insurance claim to his/her manager to authorize a better negotiation provided that you are working out with sincere and sensible insurance specialists (insurance affordable).

When an insurance holder is hurt as an outcome of a qualifying accident, they can anticipate to get settlement from their insurance policy service provider (cheaper). This settlement is planned to cover damages like past, as well as future clinical costs, a loss of incomes, a loss of possible future earnings, or any kind of discomfort and enduring the insurance policy holder might have needed to withstand.

Policyholders have every right to negotiate with an insurance case insurer to battle the lowball deal. Dealing with an insurance insurer can be challenging without the proper aid. Because of this, it is in your benefit that you seek support from an attorney that is a professional at discussing with insurer.

Just how To Negotiate an Injury Settlement Insurance Claim With Nationwide Insurer, Nationwide insurance holders that are trying to receive an ample settlement from their insurance protection plan, normally ask our attorneys a wide series of concerns concerning just how best to bargain with their insurance policy adjuster (suvs). Some of these frequently asked questions are bulleted below: What are the very best settlement methods versus Nationwide Insurance? What are the very best settlement techniques to use against Nationwide Insurance coverage for an automobile accident? Do Insurer like Nationwide have my finest interest in mind? Just how do I settle a crash injury insurance claim with Nationwide How do I bargain with an insurance coverage declares insurer In an ideal world, insurance holders can obtain a reasonable settlement insurance claim from their insurance provider.

All about What Do Auto Insurance Claims Adjusters Do?

They may state that they have your finest rate of interest in mind, yet at the end of the day, they will still try to award policyholders with as little payment as possible. Therefore, it is extremely suggested that you learn exactly how to bargain an injury settlement with Nationwide Insurance effectively - car.

This includes every little thing involved in your injuries, such as clinical costs, recurring treatment expenses, discomfort and also suffering, and also a loss of earnings. dui. For instance, if you were associated with a vehicle crash, when making your car mishap negotiation claim it is best to go past whether your car was a total loss.

In practically all conditions, your claim insurer will likely decline your settlement deal at. They will try and also make a counter offer that is far under your first demand for payment. This technique is usual amongst insurance policy insurers and also is used to identify just how much 'fight' you have in you, and also whether the claim can be cleared up swiftly.

As mentioned numerous times prior, insurer do not always have your benefit in mind as well as will do their ideal to provide you as little bit a claim as feasible. While you can go it alone, there is no guarantee that an insurance provider, like Nationwide, will give you the settlement you are entitled to as well as require for your damages.

At Normandie Law Practice, our professional attorneys have years of experience in discussing not just with Nationwide Insurance however insurer throughout the United States - cheap insurance. Our regulation firm is based in Los Angeles. Our lawyers still practice in San Diego, Orange County, Riverside, Bakersfield, San Francisco, Fresno, Sacramento and also throughout the state of California.

In these instances, their company is based a lot more on volume and will attempt to authorize up as several instances as feasible. In turn, they will invest less time on cases resulting in badly reduced settlements.

All About How Do You Fight An Insurance Company On A Totaled Car?

Insurance coverage business are not up to speed up on this by any type of stretch. If your automobile is totaled by wreckage or flood damages, or swiped and not recouped, you are going to be required to deal with an insurance coverage declares insurer.

auto insurance cheaper cheaper car insurance cheaper car insurance

auto insurance cheaper cheaper car insurance cheaper car insurance

cheaper suvs accident cheap car

cheaper suvs accident cheap car

Many individuals simply say OK, and approve that it is fair (vehicle insurance). This is a mistake. You can virtually count on the first offer being low. As quickly as you understand there is a possibility of your car being amounted to, begin to do your homework, so when that negotiation call comes, you immediately know if it is low or acceptable, it desires all your cash, and also the factor you pay insurance costs.

I examined the insurance deal that he regarded "OKAY" and also informed him it was way reduced. In this situation, the adjuster missed out on that the truck was a diesel engine, and the case amount jumped by $5000. Remember also, in many states the insurer is called for to pay substitute worth, not wholesale or publication worth, or auction costs, yet the amount you would certainly need to pay if you enter into the free market and also discover the closest lorry to the one that was wrecked.